In The Boardroom

-

The Board of Trustees were honored to present Eric Goldstein (Board Trustee 2012-2024) a small token of appreciation for all of his time, effort and expertise on behalf of the Plan. Thank you Eric for a job well done !!!!

-

The Board of Trustees formally recognized Michael West (Chairman of the Board 2006-2024) for his leadership on behalf of the Board. It is said that leadership is the capacity to translate vision into reality. Under Mike's leadership, the Plan is in a much better position to protect our Protectors. Thank you Mike!!!

-

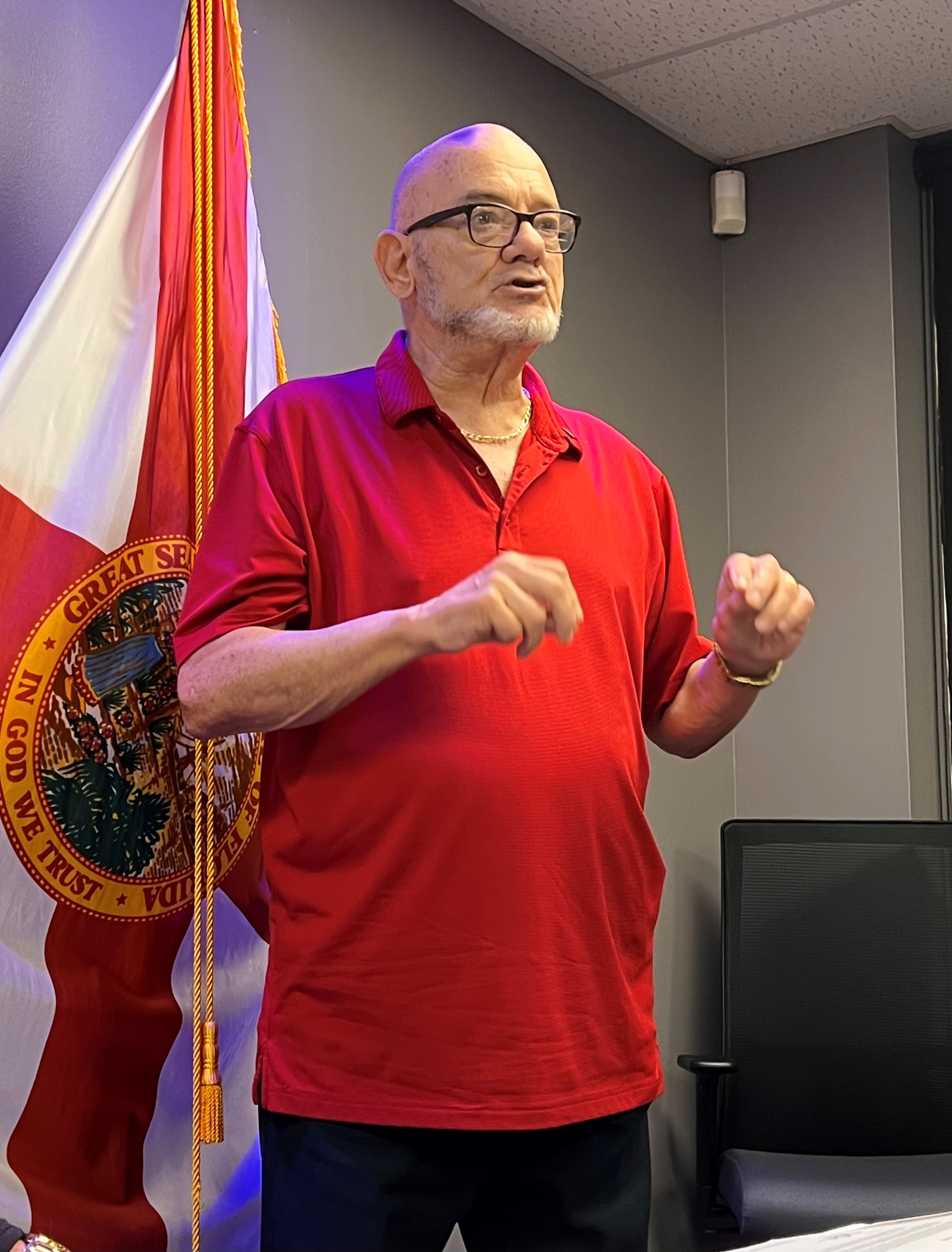

Retired Captain Pete Eckert made a passionate plea to the Board of Trustees to select a sunrise police retiree for the open position on the Board. The two city appointees did not agree and the Board remains with only four members.

The FOP and the PBA also endorsed a police retiree for the position. You may read further by clicking the following links:

Letter from BCPBA

Letter from City of Sunrise Fraternal Order of Police -

After 31 years, Congratulations to Mark Krumenacker. Thank you for your dedicated service and we wish you all the best in this next chapter of your life.

-

The Board of Trustees presented William Bettencourt with a token of appreciation for his dedicated service as the Board Secretary 2012-2024. Bill is the literal definition of "Plan Fiduciary" and his wisdom will be missed. Mr. Bettencourt also received the Chairman's Achievement Award.

-

The Board of Trustees presented Anthony Bulzone, City of Sunrise - Finance Dept. the prestigious "Bull & Bear Award" for his on-going commitment to our Plan. Anthony serves as the city liaison to the pension plan. Anthony is a true professional and his partnership is truly respected, admired and appreciated.

-

The Inaugural Chairman Achievement Award presented to William Bettencourt.

-

The Board of Trustees presented Keven Sweat with a token of appreciation for his dedicated service as Trustee of this Plan.

-

The Board of Trustees received investment portfolio updates from ASB Real Estate Investments and Barings Core Property Fund.

-

The Board of Trustees met with several plan professionals at this quarterly meeting. Pictured here is the JPMorgan Team who reviewed the International Focus Fund. This portfolio outpaced the benchmark on all time periods since inception dating back to 2015. Keep up the great work!

-

The Board of Trustees had the pleasure of hearing from Mr. Terrance Miller and Mr. Matt Williams from Crawford Investment Counsel. The representatives reviewed their firm's Managed Income Strategy. The product seeks to provide a high level of current income while managing portfolio risk. The strategy seeks attractive, higher yielding opportunities that are available in specialized subsets of the capital markets. Investing in a variety of income producing asset classes provides the ability to achieve greater diversification. AndCo, the Board's Investment Consultant vetted this product and confirmed the diversification factor while mitigating risk. The Board will consider this investment at the February 13, 2023 meeting.

-

The Board of Trustees received an updated portfolio report from Deb Schwartz, Portfolio Manager from Barings Real Estate. Since inception (July 1, 2017) the return was valued at 9.73%. On a shorter of three years, the portfolio returned 11.00%. During the last twelve months through June 30, 2022 the return was balanced at a stellar 25.19%. Keep up the Great Work!!!

-

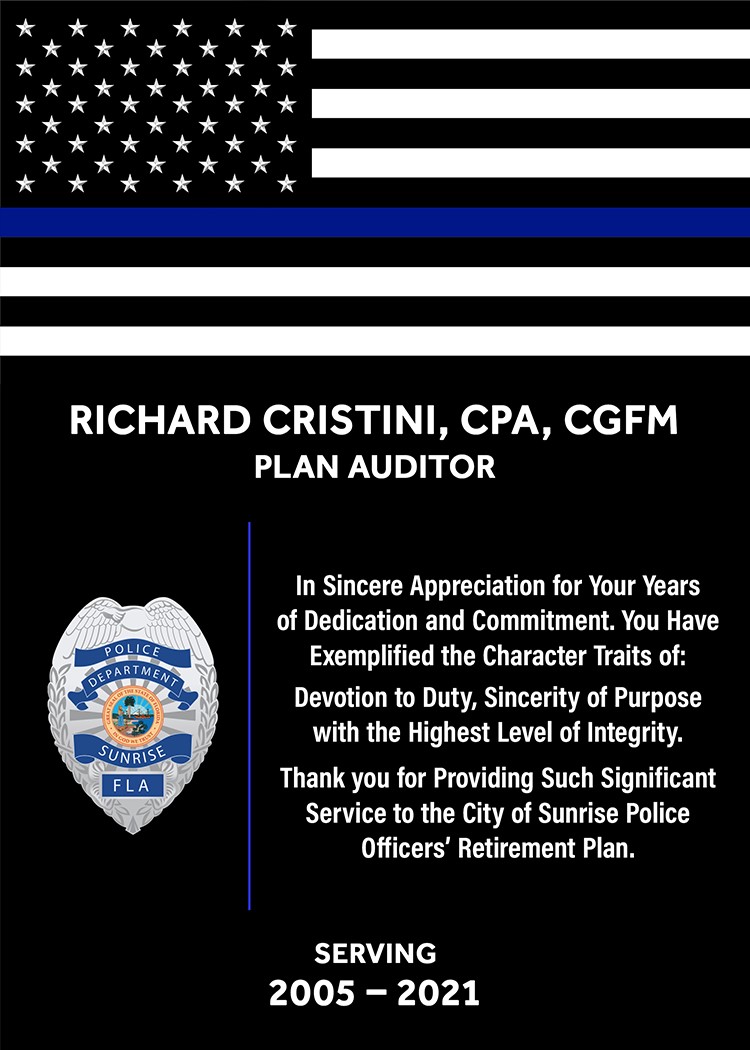

The Board of Trustees presented Richard Cristini with a token of appreciation for his professional services rendered during the Plan Audits 2005-2021.

Pictured L-R Chuck Landers, Richard Cristini and Jeanine Bittinger.

To learn more about the firm please visit: https://www.saltmarshcpa.com -

The Board of Trustees presented Richard Cristini with a token of appreciation for his professional services rendered during the Plan Audits 2005-2021.

Pictured L-R Chuck Landers, Richard Cristini and Jeanine Bittinger.

To learn more about the firm please visit: https://www.saltmarshcpa.com -

The Board welcomed the Audit Team from Saltmarsh, Cleaveland and Gund, which is one of the largest full-service accounting and advisory firms in the Southeast, offering deep expertise and specialized consulting.

Pictured is Chuck Landers, CPA, CIT

Chuck is a shareholder in the Audit & Assurance Services Department of Saltmarsh, Cleaveland & Gund. -

The Board of Trustees would like to thank the representatives from Entrust for an outstanding presentation on the Global Special Opportunities Fund. Pictured: Robert Guariglia and Bryan Schneider (Jeff Marano not pictured).

-

Representatives from Barings presented their report in the real estate portfolio. In short, the portfolio returned 6.74% net on an annual basis since inception of July 1, 2017. At the direction of the Board of Trustees, this portfolio was funded from the fixed income portion of the fund. Real estate out paced the fixed income by 400+ basis points.

Keep up the great work. -

Mr. Jim Haynes from Polan Capital presented portfolio results for the Large Cap Growth sector. Polan returned 16.93% for the quarter ending March 31, 2019. In the prior fiscal year Polan beat the index by 234 basis points. Keep up the great work.

-

The Board of Trustees welcome Trustee Keven Sweat as the City Appointee.

-

Mr. Clyde Robinson, Managing Director - Head of Client Services from ASB Real Estate Investments presented a portfolio review to the Board of Trustees. ASB Real Estate Investments (ASB), a division of ASB Capital Management, LLC, is a leading U.S. real estate investment management firm. Headquartered in Washington, DC, ASB invests in major urban markets across the U.S., concentrating in office, multifamily, retail and industrial properties. Allegiance Fund Overview and Investment Attributes were detailed. A $5,000,000 investment was made in this portfolio in July of 2017 after struggling for years for an ordinance change, due to the dismal fixed income returns in the market. Our portfolio gained 7.01% since that time and the Board is reinvesting the returns accordingly.

-

Trustee Louis Berman picture right listens to the presentation of Mr. Charlie Murrin, CFA of Barings Core Property Fund. Mr. Murrin detailed Barings Investment Capabilities,their Global Platform With Local Execution and the Barings Core Property Fund Team. An initial investment of $6,000,000 was made on July 1, 2017. The net return to date has been a stellar 7.27%.

-

Nick Field (pictured) from JPMorgan spoke about the International Unconstrained Equity Fund. On a one year basis, the portfolio returned 16.03%, and on a three year basis beat the index benchmark by 148 basis points.

-

Mr. Anthony Bulzone, Sr. Treasury Analyst - City of Sunrise (pictured below) listens intently to a presentation by Mr. Anthony Xuereb, Senior Relationship Manager from Polen Capital (pictured above). Polen is the large cap growth manager for the Plan. The inception date for Polen is quite short, but during the limited duration, Polen has outpaced the benchmark by 146 basis points.

-

Mr. Anthony Bulzone, Sr. Treasury Analyst - City of Sunrise (pictured below) listens intently to a presentation by Mr. Anthony Xuereb, Senior Relationship Manager from Polen Capital (pictured above). Polen is the large cap growth manager for the Plan. The inception date for Polen is quite short, but during the limited duration, Polen has outpaced the benchmark by 146 basis points.

-

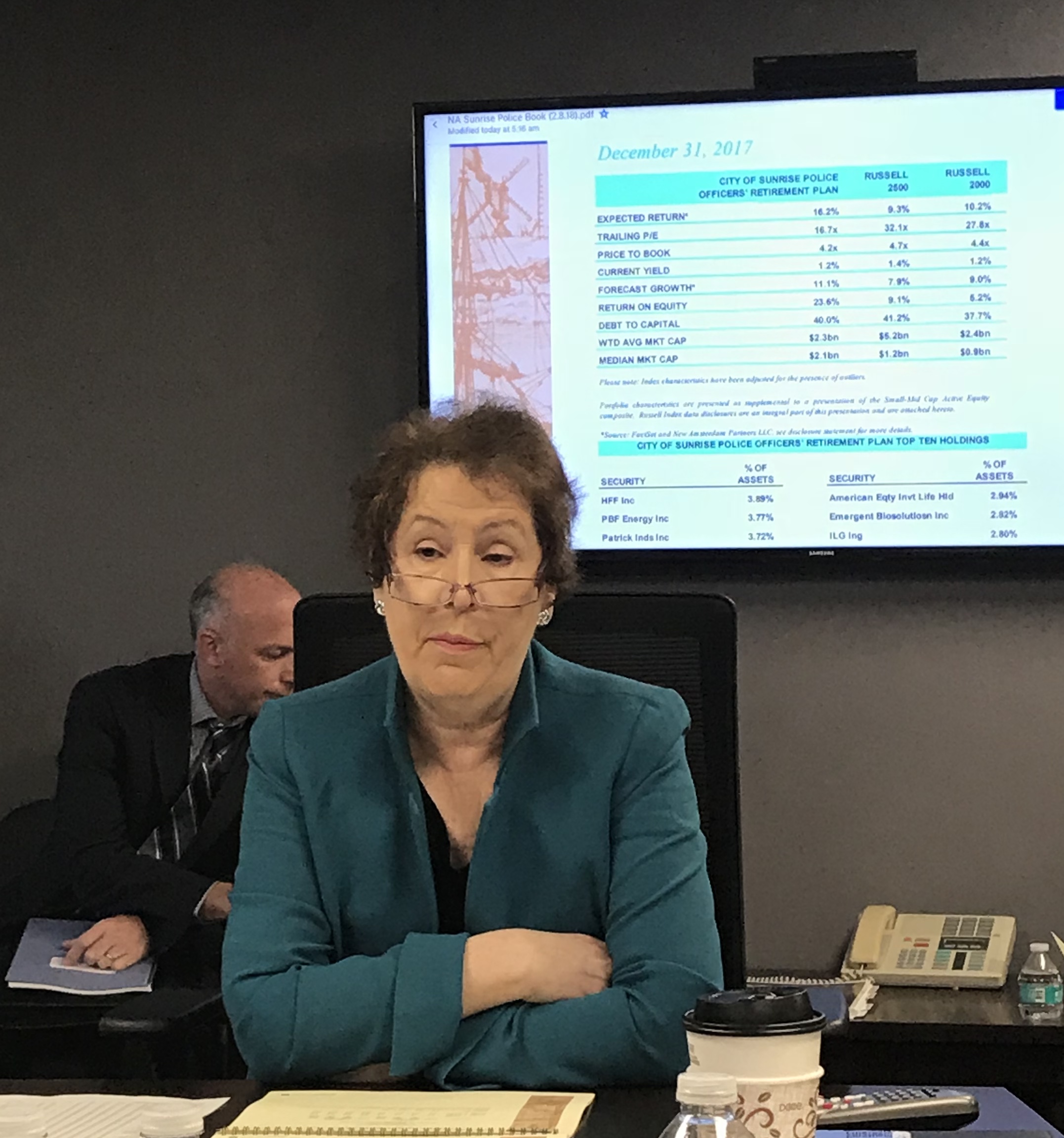

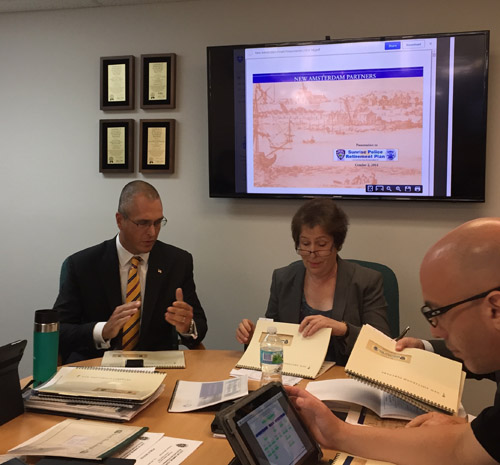

MICHELLE CLAYMAN, CFA of New Amsterdam detailed the investment process to the Board of Trustees. Fundamental research and sell discipline was also outlined.

As of December 31, 2017, the portfolio had a market value of $14,977,013.12. The allocation at the end of the quarter based on each asset class is as follows: 1.1% in cash, 45.5% in growth equity, 52.5% in value equity and 0.0% in multi-cap equity.Investment performance for the quarter by asset category is as follows: Value -0.2% vs. the benchmark of 4.0%, growth 6.0% vs. 6.4% which equates to a quarterly return of 2.5% vs. 5.2%. These numbers are gross basis.The investment return on a fiscal year basis -Value 11.2% vs. the benchmark of 10.5%, growth 8.6% vs. the benchmark of 23.3%, which equates to an annual return of 10.3% vs. 16.8%. These numbers are gross basis.It was reported that size and style factors hurt returns. Larger capitalization names outperformed smaller cap names in the Russell 2500 by more than 600 basis points. High Price to Book (PB) companies outperformed low PB companies by over 300 basis points. New Amsterdam's Growth at a Reasonable Price approach looks for companies with above average forecast growth and return on equity selling at relatively low PB ratios so this also proved to be a headwind.

Ms. Clayman feels the portfolio is well positioned for the following reasons: Higher forecast earnings growth and return on equity; solid cash flow generation; lower balance sheet debt; and better quality financial accounting. -

Mr. Richard Cristini & Ms. Jeanine Bittinger of Davidson, Jamieson and Cristini presented to September 30, 2017 Financial Statements to the Board of Trustees. Mr. Cristini stated, "In our opinion, the financial statements present fairly, in all material respects, the fiduciary net position of the City of Sunrise Police Officers' Retirement Plan as of September 30, 2017 and 2016, and the changes in fiduciary net position for the years then ended in accordance with accounting principles generally accepted in the United States of America".

Click here to review the report in detail.. -

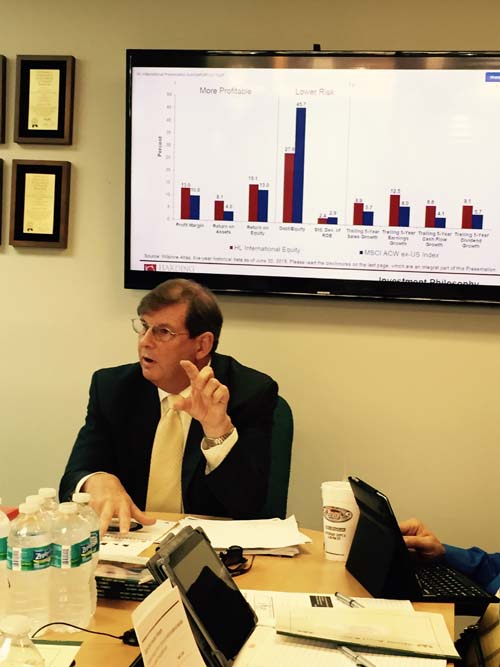

JPMorgan International Unconstrained Equity Fund representatives reported to the Board that as of March 31, 2017, the fund was in the Top quartile performance over 3 years and top-quintile performance since inception. Top-decile performance over 3 years and since inception. Outperformed MSCI ACWI ex US by 2.5% annualized since inception (net of fees) while maintaining volatility similar to the benchmark. 3rd percentile batting average (61.7%) and attractive up/down capture of 98% and 85% respectively over 5 years. International stocks are attractively valued relative to the U.S. and are starting to see a long anticipated recovery in earnings. Global manufacturing momentum looks positive, especially in the Eurozone and the UK.

-

Mr. Jeff Amrose, Board Actuary from GRS Consulting discussing the Actuarial Valuation report with Trustees. The entire report may be viewed on the: Sunrise Police Pension Disclosures Page.

-

Mr. Jeff Amrose, Board Actuary from GRS Consulting discussing the affects of the 415 limitations with Trustees Berman and Bettencourt. Further details on the Sunrise Police Pension Announcements Page.

-

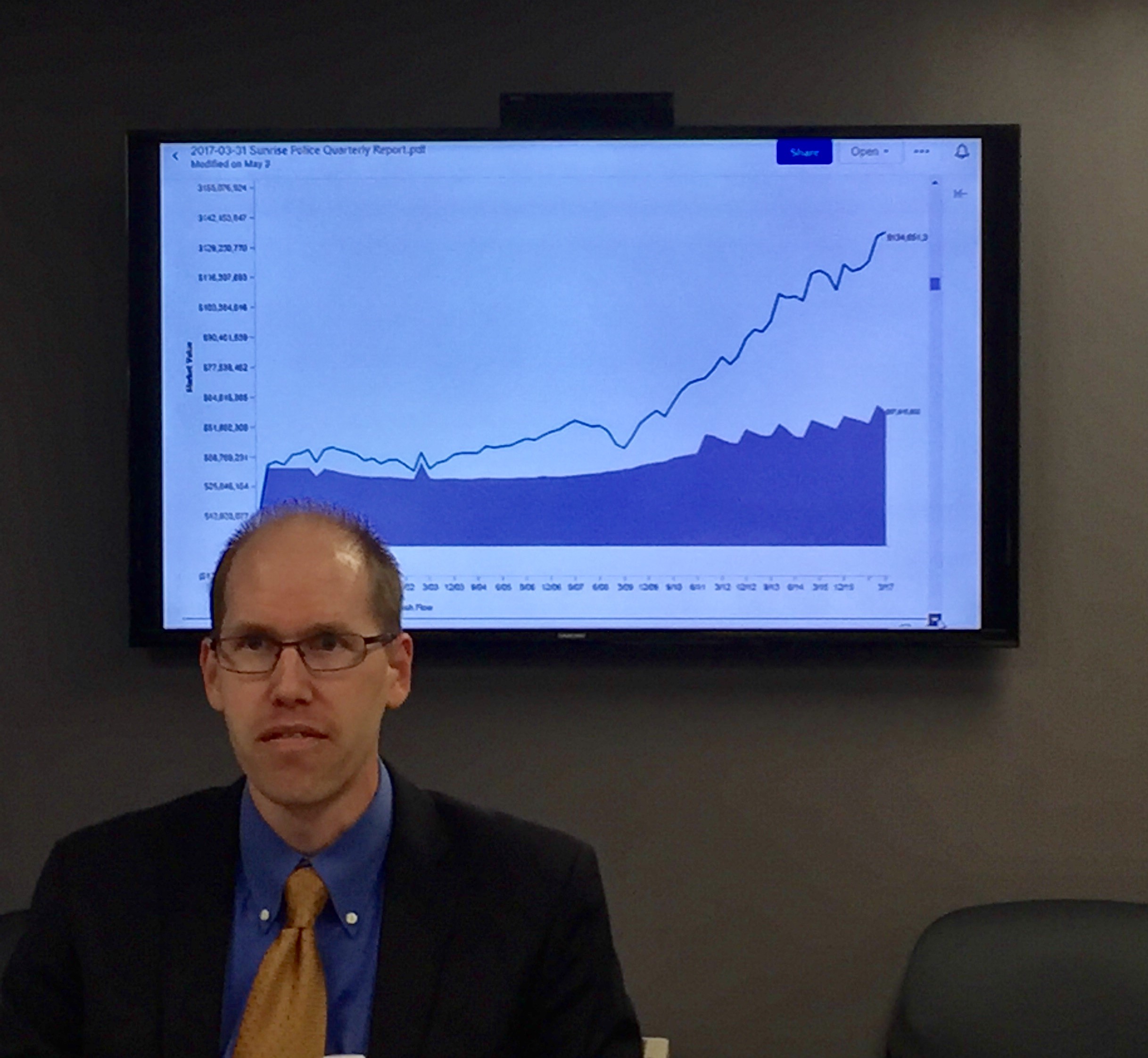

Mr. Brendon Vavrica, CFP®, Investment Consultant from AndCo Consulting presenting the March 31, 2017 investment report to the Board of Trustees. The entire report may be viewed on-line on the: The Sunrise Police Pension Investments Page.

-

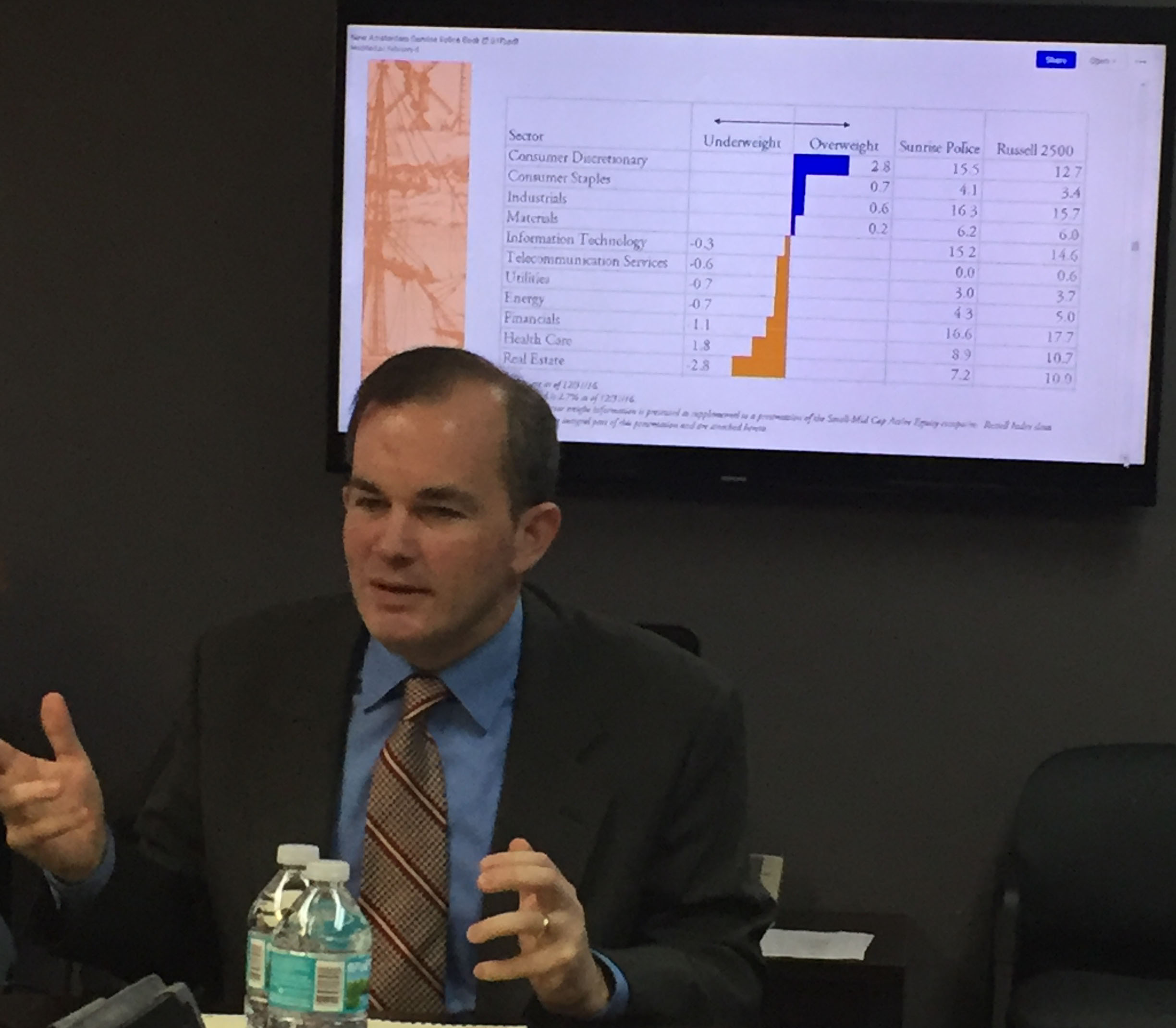

Rich McCloskey, CFA from New Amsterdam Partners presented an update of the small cap equity portfolio. The December 31, 2016 quarter ended the year with a 12.31% return in comparison to the Russell 2500 Index Return of 6.12%. From inception of December 2014, the portfolio return beat the index by 326 basis points.

-

Brendon Vavrica, CFP, began his presentation by introducing the Board to the new firm name. The Bogdahn Group re-branded to AndCo Consulting in 2017. Brendon pointed out, "On the cover of your standard quarterly report (pictured), Sunrise's plan name comes before theirs. That is not by accident. Everything from the services we provide to how we are structured as an organization is designed to ensure that you, our client, comes first."

In brief, the portfolio is valued at $122,271,148 and the quarterly return for the plan was 2.44%, which ranks in the TOP 4% of the investment universe. The Public Plans - Total Fund Median Return was 0.73% for the quarter. On the one, three and five measurement periods, our plan ranked in the TOP 6, TOP 28th and the TOP 23rd respectively. Remember the entire investment report may be viewed Here. -

Trustee Roger Torres was recognized for his service to the Plan, during today's Board Meeting. Thank you Roger!

-

Chairman Michael West presents the former Trustee Louis Berman with a token of appreciation for his many years of dedicated service to the Plan. Job well done Lou!

-

Ms. Kate Morgenier, Relationship Manager, Vice President & Mr. Nick Field, Client Portfolio Manager, Vice President presenting the September 30, 2016 portfolio report for J.P. Morgan International Unconstrained Fund. Top-quintile performance was reported over one year, three-year periods and top decile since inception. Keep up the great work!

-

The Board of Trustees heard from a host of service providers. Steve Loncar, Director - Client Portfolio Manager Ceredex Value Advisors LLC.

-

The Board of Trustees heard from a host of service providers. Brendon Vavrica of The Bogdahn Group and William Bettencourt, Board Secretary engage actively about the market outlook.

-

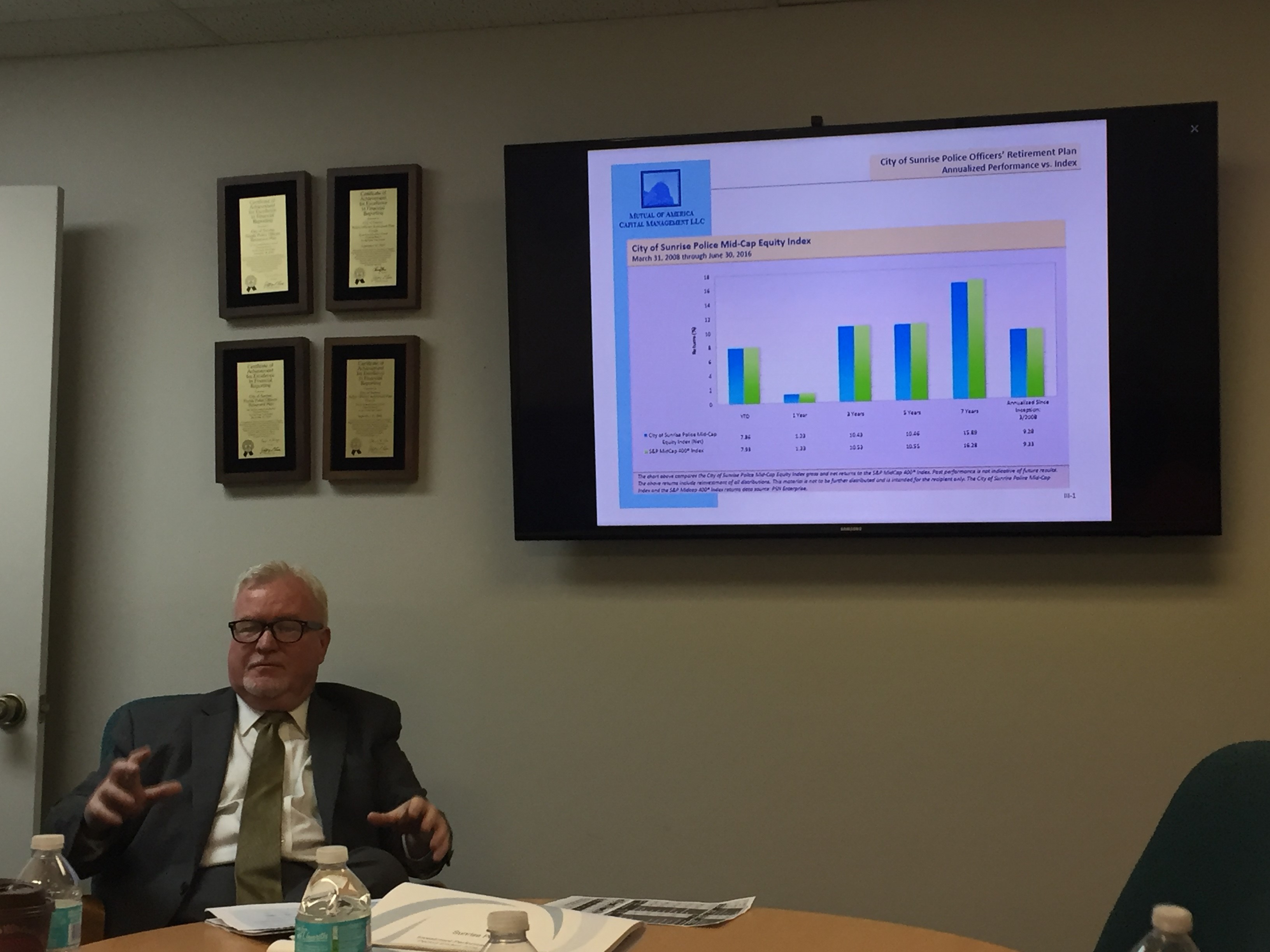

The Board of Trustees heard from a host of service providers. Kevin Quinn, Vice President, Marketing Mutual America Capital Management presents the Mid-Cap returns.

-

Chairman Michael West reflects upon the 120 million dollar milestone the Plan has reached in assets!

-

The Board of Trustees heard from a host of service providers. Janna Hamilton announces that Garcia Hamilton is awarded! Congratulations on a job well done!!!

-

The Board of Trustees was introduced to Mr. Michael Welker (pictured Left). Mike is the President/CEO of The Bogdahn Group. The Bogdahn Group is an independent, registered investment consulting firm who our current Monitor, Thistle Asset Consulting (pictured: Mr. Brendon Vavrica & Mr. John McCann), recently merged with. The Monitor assists the Board of Trustees with Investment Policy Development, Strategic Asset Allocation, Manager/Strategy Evaluation, Generate Monthly and Quarterly Investment Reports, Quarterly Economic Summary, Board/Investment Committee Education, Investment Manager Searches, Custodian Evaluation, Investment Manager, Due Diligence, Assist with Asset/Liability Studies and Attribution and Style Analysis.

-

Clay Cochran and Ryan Donohue of JP Morgan. After careful consideration and deliberation the Board of Trustees has selected J.P. Morgan.

-

Mike Shantz and Donald Sanya of RBC Global Asset Management.

-

Bill Adams and Carl O'Connell of the Boston Company.

-

International Equity Search Presentations. Pictured here: Mr. John Parsons of Harding Loevner.

-

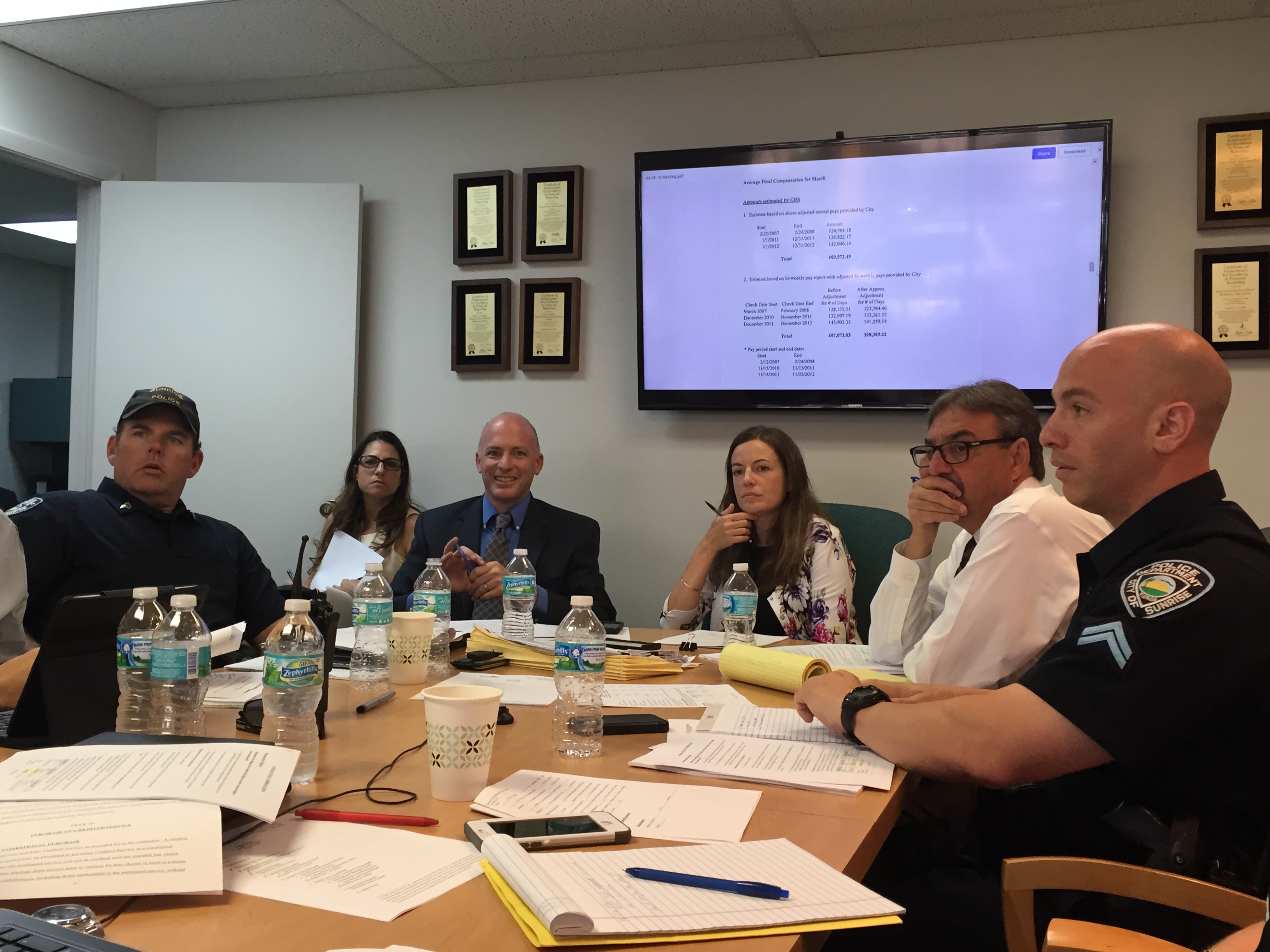

Trustees, Jeff & Trisha Amrose, Board Actuaries and Ron Cohen, Board Attorney discussing AFC, Payroll deductions for Buybacks and Real Estate investing with Richard Salamon, City Manager - City of Sunrise.

John McCann, Investment Monitor reported our Plan would have earned an additional 1.7M, if we were permitted to invested in Real Estate over a two year period ending September 30, 2014. -

Board of Trustees unanimously selected New Amsterdam Partners as their new SMID manager.

-

Board of Trustees interview SMID Cap Investment Firms.

Pictured here: Earnest Partners, Atlanta. -

Brendon Vavrica and John McCann of Thistle Asset Consulting provides quarterly investment report to the Board of Trustees.

-

Board of Trustees honor Former Chairman Robert J. Dorn.

-

Board Attorney, Richelle Levy debated the calculation of the AFC with the Board of Trustees. The Board will meet on April 2, 2015 to draft an administrative procedure.

-

The representatives from Davidson, Jamieson & Cristini, PL. presented the 09-30-2014 independent audit results to the Board of Trustees. For transparency this report is posted to the announcement page along with the Memorandum on Review of Internal Control Structure.

-

Steve Loncar presents the Ceredex Value Advisors Investment Report.

-

Curt Rohrman and Janna Hamilton of Garcia Hamilton & Associates appear before the Board to review September 30, 2014 investment review. The GHA Equity return was ranked in the Top 1% for the reporting period. Congrats to GHA and keep up the great work!!!

Recent Announcements

- 2026 BBFF Fishing Tournament - 2026/04/18

- NOTICE OF CHANGE OF ADDRESS & PHONE - SUNRISE POLICE RETIREMENT OFFICE - 2026/01/06

- Important Notice: Change in Custodian Services Effective January 2026

- Pension Board Ordinance - Investment Authority 124 X 25 B

- Pension Board Ordinance - Extending Terms 124 X 25 A

- ATTENTION MEMBERS: Website Info

- Mayor Response - 2025/06/02

- CM Rebuttal

- Deborah Sears Obituary

- SPPF Mail Patty Ostrander - 20 YOS Notice - 2025/05/12